2021 Report

Women Physicians Financial

Preparedness

Selecting a Fiduciary Advisor—A Guide for Women Physicians

If you haven’t yet engaged a professional financial advisor or are wondering if you are in the right advisor/client relationship, here are five steps you can take to find the right partner and coach to help you realize your goals.

In the 2021 ACP Physicians’ Financial Preparedness Report more than 450 female internists shared details about their personal financial lives, including their use of a professional advisor for assistance with retirement planning, investments, trusts, and insurance.

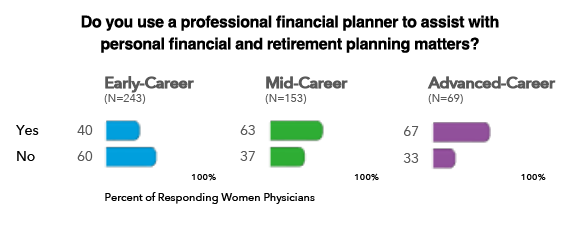

Two-thirds of women physicians in practice for 17 years or more have engaged a professional financial planner, according to the study. Among those with a planner, more than 80% said their advisor is a Certified Financial Planner (CFP).

The study also found that internists who work with a professional planner are more likely to feel on-track or ahead of schedule for retirement, have more in retirement savings than peers in the same age and career stage, and express greater confidence in decisions they are making. They are also satisfied with their advisor and are proponents of working with one.

Still, only 40% of women in their early-career use an advisor for a number of different reasons.

Findings indicated that 20% of internal medicine physicians prefer to DIY their financial and retirement planning—preferring to self-educate, spend time up front to set things up, and make modifications as needed. “It is so much easier than learning medicine,” said one woman internist.

Others without an advisor say the cost is too high, they don’t have enough savings to warrant the cost, or they haven’t found someone they trust.

We invited Certified Financial Planners, Amy Braun-Bostich, CFP, and Cassandra Kirby, CFP, from the independent advisory firm Braun-Bostich & Associates, to review the 2021 ACP Physicians’ Financial Preparedness Report and provide their thoughts on selecting the right advisor.

- Talk to at least three potential advisors. Pay attention to personal chemistry. You want someone with whom you can get along, someone who “gets” you, your financial situation, goals and your attitude toward risk. Are you comfortable asking questions?

- Check the credentials counsels Cassandra Kirby from Braun-Bostich, who earned her CFP in 2009. A Certified Financial Planner (CFP) is a fiduciary. This means they review options available to you and provide advice that is in your best interest. They simplify the complexity while educating you along the way. Check to see if your current advisor is a Certified Financial Planner through the CFP website.

- Understand the scope of work and the fees. According to Braun-Bostich, you should expect to pay a bit above 1% to manage a $500,000 to $1 million portfolio. For $1 million to $3 million, it’s at 1%. But this also depends on the amount of work the advisor is going to be doing for you. Some advisors really do nothing more for the 1% than investment advice, and others do a lot of planning and stress-testing, which is time consuming. Make sure you understand what you’re getting even if you must pay a little more.

- Connect with one or two clients of the advisor you are considering. Ask how satisfied they are and get additional insight on how they are to work with.

- Don’t stay with someone who “drives you crazy.” Your first or second advisor relationship may not be one you could endure for the long haul. If there is a personality conflict during planning, imagine what it could look like when working through an urgent and important financial decision together.

“Ultimately as you build complexity in your portfolio, you may appreciate understanding the options without having to do all of the work”, says Braun-Bostich. It’s hard enough when you have to stay on top of everything in the medical field. Your advisor can weed through the things that don’t apply to you.

The 2021 ACP Physicians’ Financial Preparedness Report and related articles are the result of data and insights captured from more than 1,250 practicing internal medicine physicians including 469 women ACP members. Each shared their attitudes and behavior around personal finances, debt, retirement savings and estate planning. Find more information on physician benchmarks, retirement planning, and other financial insights at acpmemberinsurance.com.